“Jessica Hand and Mike DesRoches are juggling numerous financial goals, but saving for retirement is one ball they’ve had to let drop over the last year.

After the mortgage payment and other bills, the couple are barely breaking even. In fact, they recently dove deeper into debt to fund Ms. Hand’s tuition for graduate studies and a DIY basement bathroom renovation – all in the midst of expecting their second child,” wrote Joel Schlesinger for The Globe and Mail on October 22, 2015.

Schlesinger continued, “Moreover, savings rates are declining, too. Only 28 per cent of workers age 25 to 34 make RRSP contributions while only 34 per cent of those between age 35 and 44 contribute. A decade ago those figures were 36 and 42 per cent respectively, according to StatsCan data.

And overall personal savings rates have fallen from 20 per cent of household income in the early ’80s to less than five per cent in 2010.

Yet over the last 20 years, wages have grown even if Canadians’ capacity to save has not.

In 1985, median household income was about $24,000 – or about $48,000 in today’s dollars – while in 2012 median household income was about $77,000, according to StatsCan data.

Yet wage growth has not kept pace with the cost of housing. The median price of a Canadian home in 1985 was about $78,000 – or about $157,000 in today’s dollars – while the median price for a home in 2015 is $433,267.”

Read the full article here.

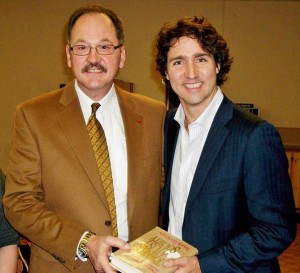

Raymond Matt, CFP, CLU, TEP, CHS